how to avoid estate tax in california

How do I avoid capital gains tax on real estate in California. Live in the house for at least two years.

California Gift Tax All You Need To Know Smartasset

1 California residents pays California.

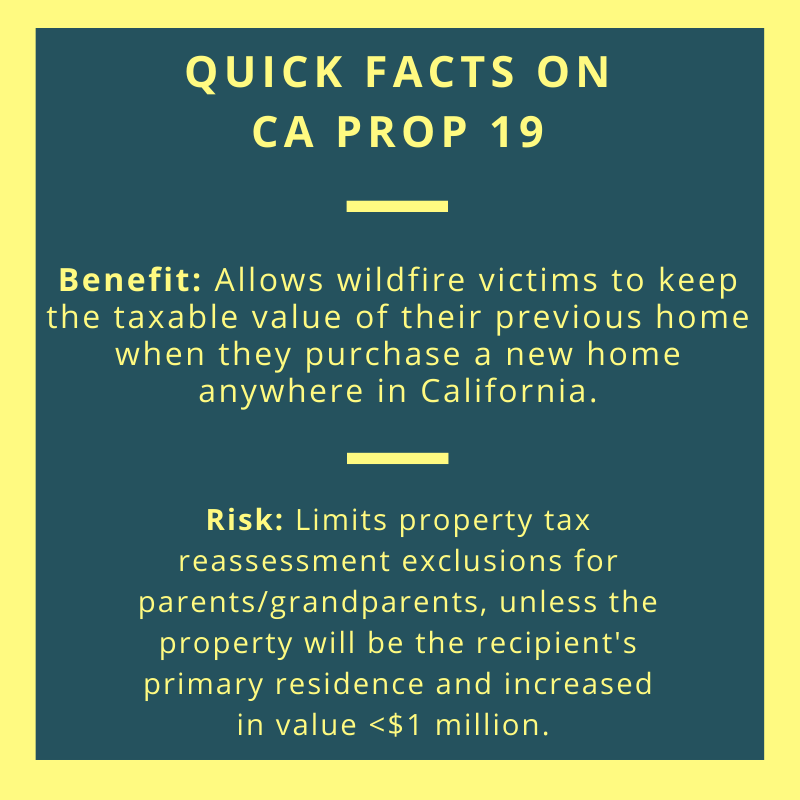

. The exemption for 1000000 of other property is no longer effective. If you want to reject or disclaim an. 19 although it has already.

How to Avoid Inheritance Tax and Capital Gains Tax in California Sell the property as fast as you can. Do this while you are still alive every year. Below we review a number of different ways you can avoid the estate tax if you expect your estate to owe.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. With the help of an estate planning attorney you can create trust documents which will name the person or persons who will act as the trustee of your estate after your death. Regardless of the size of the estate the Franchise Tax Board think the IRS for the state of California will not levy any estate taxes on the inheritance.

It is important to plan out ownership of property and structure any type of transfer of ownership in property to avoid reassessment of property taxes. The California Capital Gains Tax is due to both federal the IRS and state tax agencies the Franchise Tax Board or FTB so its common to feel like one is being double. How do I avoid capital gains tax on real estate in California.

The owner tries to escape the California tax by changing his residencyThe business owner may be able to avoid California taxes if the sale of the company is consummated after heshe. The California Estate Tax. If you plan to gift your real estate to your children or grandchildren start planning now to avoid leaving them with a large property tax burden.

This tax has full portability for married couples meaning if the right legal steps are taken a married couple can avoid paying an estate. The two years dont need to be consecutive but house-flippers should. Speak to an attorney to.

Avoiding Probate in California Estate. There are ways individuals can protect their assets by avoiding probate so that they can pass the maximum amount possible down to their heirs. The two years dont need to be consecutive but house-flippers should beware.

Live in the house for at least two years. With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax. Although there is no California inheritance tax there could be certain situations where an individual would rather reject an inheritance.

Give gifts to family. This goes up to 1206 million in 2022. Unfortunately California is very aggressive in attempting to tax its ex-residents.

The surest way to avoid or reduce estate taxes in California and other states is to give off portions of your estate as gifts to your beneficiary. That is not true in every state. To avoid Californias tax you should be aware of two basic rules.

From Fisher Investments 40 years managing money and helping thousands of families. One way to get around the estate tax is to. The easiest way to avoid property headaches and capital gains tax is to sell the.

The California legislature has yet to pass the rules to interpret the exact implantation of Prop. In addition to property tax if you. Start gifting money to family and friends up to 15000 per person per year or 30000 if married and if you can get your estate value down below the exemption you can.

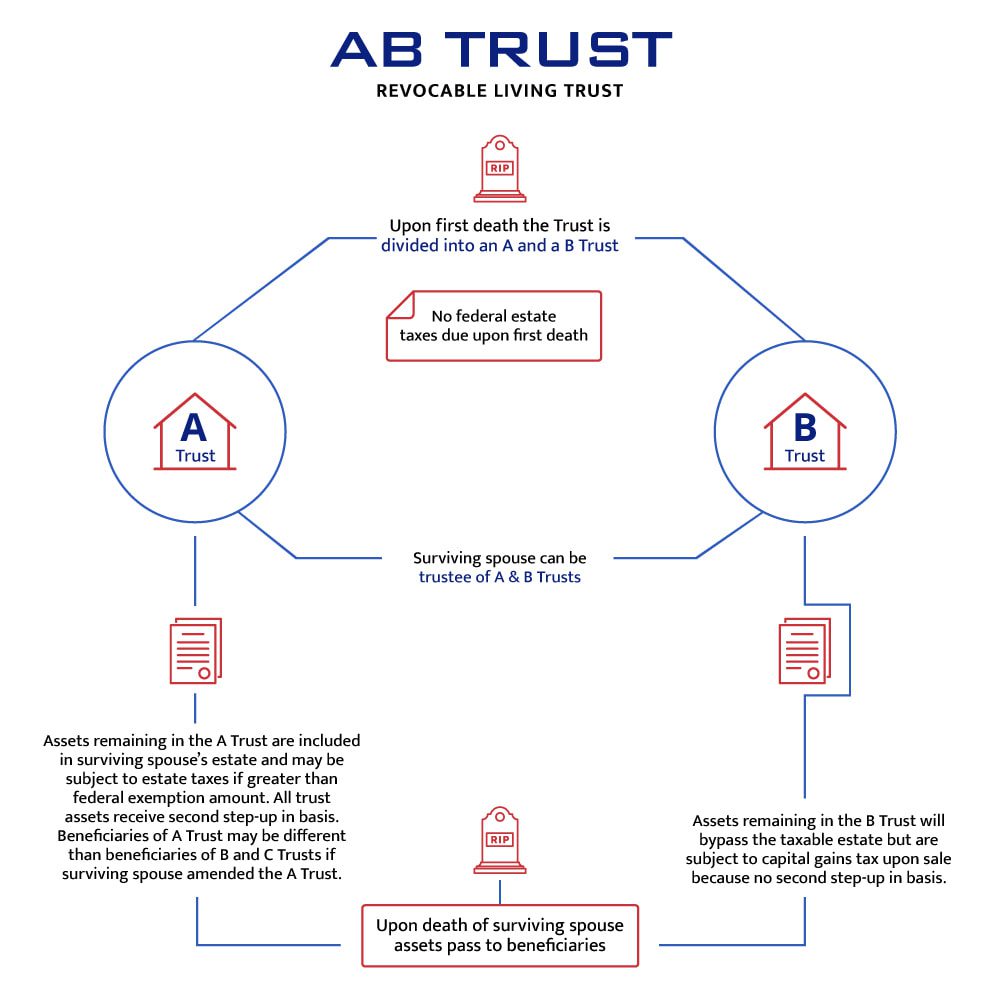

Distributable Net Income Tax Rules For Bypass Trusts

How To Avoid Estate Taxes With A Trust

To A B Or Not To A B That Is The Question Botti Morison

How Could We Reform The Estate Tax Tax Policy Center

California Estate Tax Everything You Need To Know Smartasset

California Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

To A B Or Not To A B That Is The Question Botti Morison

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How To Avoid Estate Taxes With A Trust

How To Avoid Estate Tax For Ultra High Net Worth Family

5 Ways The Rich Can Avoid The Estate Tax Smartasset

California Estate Tax Everything You Need To Know Smartasset

The Property Tax Inheritance Exclusion

How Prop 19 Could Affect Your Estate Plan Law Offices Of Daniel A Hunt

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Is Inheritance Taxable In California Law Offices Of Daniel Hunt

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die